Winton’s eponymous flagship hedge fund is down 14.5% in the year to date until the end of May.Īll the hedge funds were contacted for comment. Global asset outflows in CTAs in Q1 2020 were $21.6bn, $19bn of which were in Systematic Diversified Strategies. It marked the first Q1 outflows in any year in that sector since Q1 2009.ĬTAs, which are designed to outperform the market in times of economic turbulence, are also failing to thrive.

Global quant equity market neutral assets also suffered, decreasing by $786m in Q1 2020. The Morgan Stanley data in the report also found that quantitative equity market neutral assets decreased by $3bn in Q1 2020. READ Quants suffer in market rout while macro and volatility funds thrive Data from Morgan Stanley shows many leading quants have failed to improve their performance subsequently. Quant firms were hit badly by the March market meltdown, particularly caught off guard by a spike in fixed-income volatility. Man Group’s AHL Alpha quant fund is up 2.9% over the same period, a person familiar with the matter told FN. AHL Dimension, the multi-strategy hedge fund run by listed hedge fund Man Group, fell 5.6% for the year ending May 2020.

The report also found Quant hedge fund heavyweight Renaissance Technologies’ Renaissance Institutional Equities Fund is down 10.9% in 2020 until the end of May. READ Ray Dalio’s Bridgewater scales down European short bets after €4bn windfall But according to a source close to the situation, Bridgewater's All Weather fund – its risk parity strategy – is faring relatively better, down only 2.8% in the year to date. Bridgewater’s Pure Alpha strategy was down 20.6% this year to the end of May. No warranty or guarantee of any kind, expressed or implied, is given regarding the accuracy, reliability, veracity, or completeness of the information provided here or by following links from this or any other page within this site, and under no circumstances will the author or service provider be held responsible, or liable for errors, or omissions resulting in any loss or damage caused or alleged to be caused by information contained in the material presented on the site, including but not limited to direct, indirect, incidental, special or consequential damages caused by using the information.Quant Trends, a 69-page report seen by Financial News, found that Bridgewater Associates, the world’s biggest hedge fund, also continues to struggle in 2020. This website is for informational purposes only and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments nor an endorsement of any particular investment advisor firm or individual. This website is ran by the H Media Group and connected to CHP Designation,, , and Family Offices Database products/services. The content of this hedge fund blog is in no way a means of hedge fund or financial advice or a solicitation to sell hedge fund products. I could help a hedge fund looking to hire additional analyst or sales people. Let me know if you are looking for a hedge fund job or are hiring someone and would like to be introduced to a few new candidates and I would be happy to network with you. One highly successful hedge fund manager said that they don't have any hard and fast experience requirements to be hired by their firm, they simply look for people who are hungry, humble, and smart.

#Hedge fund resume professional#

Certified Hedge Fund Professional (CHP) Designation.That said some of the below factors are what funds look for: Some never graduate from high school but make over $1m/year trading or selling for funds.

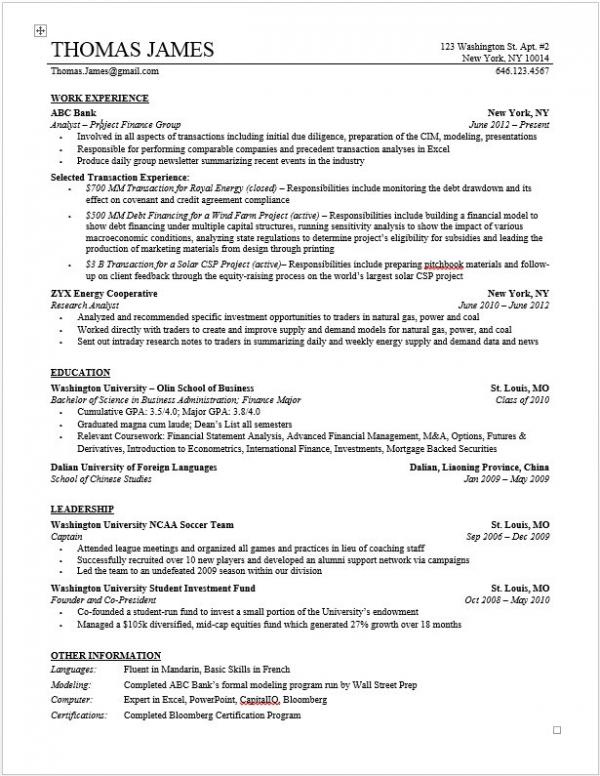

Every line on your resume should build the case of how you will make the firm more money than the guy who sent his resume in the day before you. Most open positions are sought after by dozens of 20 and 30somethings that often attended the best schools and have worked for some of the most successful banks. I have recently helped a few friends rework their resumes while they look for a new hedge fund job. Besides learning what they specialize in I found out what they typically look for in hedge fund resumes from candidates. Hedge Fund Resumes Hedge Fund Resume Tipsīefore I began working for the third party marketing firm that I am with right now I had contacted several hedge fund recruiters.

0 kommentar(er)

0 kommentar(er)